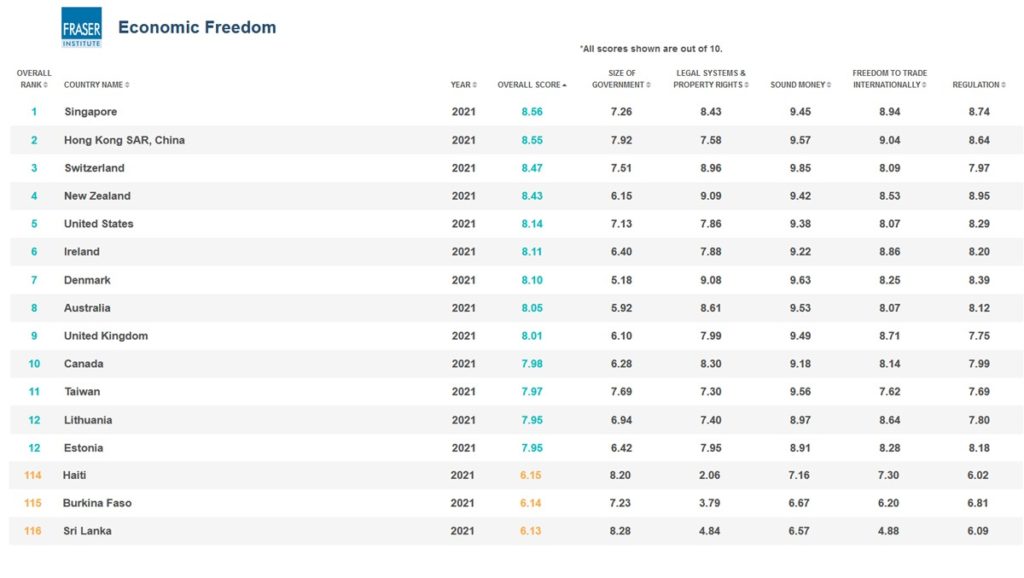

Sri Lanka has dropped 12 place in economic freedom to 116 from 104, in a ranking of 165 countries and territories, compiled by Canada-based Fraser Institute.

Sri Lanka’s fall was driven by 4 out of the 5 sub indicators of economic freedom on the size of government, access to sound money, freedom to trade internationally, and the regulation of credit, labour, and business.

The only indicators that registered an improvement in its score is the indicator of legal system and property rights.

The ranking is based on 2021 data.

“The report captured a stark warning: Sri Lanka’s economic freedom declined prior to the economic crisis of 2022, a testament to the vulnerability of nations with limited economic freedom in the face of economic turmoil,” Dhananath Fernando, Chief Executive Officer of Colombo-based Advocata Institute, which is a partner agency of Fraser said in a statement.

“If the country is to recover, Sri Lanka must prioritize economic growth within the framework of maximising economic freedom for its citizens to trade, work, and transact freely in a stable monetary and fiscal environment.”

Sri Lanka is placed below Haiti and Burkina Faso.

Sri Lanka is an IMF prone country with unsound (bad) money where the central bank prints money to cut rates (mis-target a policy rate) and trigger forex shortages and trade controls under highly discretionary flexible monetary regime.

Sri Lanka had a score of 6.57 out of 10 in sound money and 4.88 out of 10 for freedom to trade internationally, even before the currency collapse in 2022.

The countries with the most economic freedom was Singapore and Hong Kong, both of which do not have a policy rate.

In Hong Kong inflationist economic elites have no discretion to destroy money through depreciation, and in Singapore, there is a discretionary exchange rate targeting regime is in operation without a policy rate.

Lithuania and Estonia which had currency boards and then shifted to the Euro continued to score high at ranked 12 in the world. (ECONOMYNEXT)