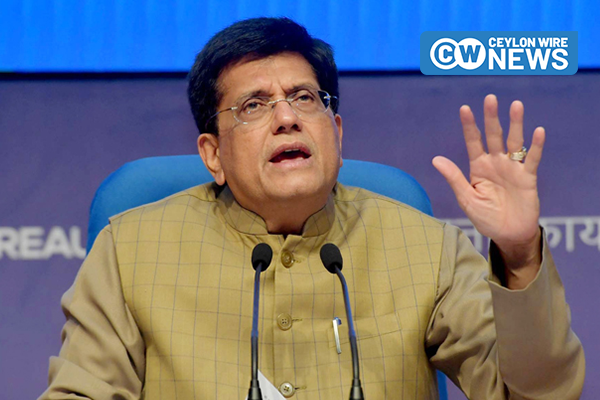

Indian Minister of Commerce and Industry, Piyush Goyal, recently disclosed that a multitude of developed and developing countries, including Bangladesh, Sri Lanka, and nations in the Gulf region, are eager to engage in trade using the Indian rupee. The motivation behind this shift is the potential reduction in transaction costs for businesses involved.

Goyal expressed confidence in this development, emphasizing its potential to be a “very game-changing” dimension for India’s international trade. He highlighted ongoing discussions with countries like Bangladesh and Sri Lanka, stating, “Bangladesh, Sri Lanka are already talking to us, and they want us to start this immediately. Other countries in the Gulf region are looking at that. I think it’ll take some time for people to see the benefits.”

According to the minister, countries are increasingly recognizing the advantages of conducting trade in domestic currencies. Goyal noted that many nations have shown interest in initiating direct transactions between their local currencies and the Indian rupee, recognizing the potential cost savings compared to transactions involving a third currency.

Goyal highlighted the UAE as one of the first countries to embrace this approach, and he anticipates more countries, including those in the Far East, to join the bandwagon. He emphasized that the process involves collaboration between central bankers of both nations to establish the framework and gain acceptance from importers and exporters.

The minister pointed out the benefits of using the Indian Rupee, which is generally stable against most international currencies. Experts believe this stability is a key factor driving other nations to establish trade relations based on rupee transactions. Additionally, the rupee trade is proving beneficial for countries facing dollar shortages.

India has already initiated rupee trade with neighboring countries such as Nepal and Bhutan. Furthermore, changes in the Foreign Trade Policy (FTP) have been implemented to enable international trade settlement in Indian Rupee, aiming to elevate the INR to a global currency status.

In July 2022, the Reserve Bank of India (RBI) permitted the settlement of India’s international trade in rupees. Authorized Indian banks are now allowed to open and maintain special rupee Vostro accounts for partner trading country banks, facilitating seamless trade transactions. Several banks, including HDFC Bank and UCO Bank, have embraced this mechanism, and numerous countries have expressed interest in adopting a similar arrangement for local currency trade.

Source – PTI